SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant [X]

Filed by a Party other than the Registrant [ ]

Check the appropriate box:

| [ ] | Preliminary Proxy Statement. |

| [ ] | Confidential, for use of the Commission Only (as permitted by Rule 14a-6(e)(2)). |

| [X] | Definitive Proxy Statement. |

| [ ] | Definitive Additional Materials. |

| [ ] | Soliciting Material Pursuant to Sec. 240.14a-12. |

Pacific Select Fund

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment Of Filing Fee (Check the appropriate box):

| [X] | No fee required. | ||

| [ ] | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | ||

| 1) | Title of each class of securities to which transaction applies: | ||

| 2) | Aggregate number of securities to which transaction applies: | ||

| 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | ||

| 4) | Proposed maximum aggregate value of transaction: | ||

| 5) | Total fee paid: | ||

| [ ] | Fee paid previously with preliminary materials | ||

| [ ] | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. | ||

| 1) | Amount Previously Paid: | ||

| 2) | Form, Schedule or Registration Statement No.: | ||

| 3) | Filing Party: | ||

| 4) | Date Filed | ||

March 26,October 5, 2020

| Re: |

Dear Contract Owner:

You currently have an investment interest in the Currency StrategiesInternational Equity Income Portfolio and, in the attached Proxy Statement, you are being asked to vote on the liquidation of the Currency StrategiesInternational Equity Income Portfolio. The Currency StrategiesInternational Equity Income Portfolio is parta fund of Pacific Select Fund (the “Trust”) and has been available as an investment option under variable annuity contracts and variable life insurance policies (the “Contracts”) issued by Pacific Life Insurance Company and Pacific Life & Annuity Company (together, “Pacific Life”).

On March 18,September 16, 2020, the Board of Trustees of the Trust (the “Board of Trustees”), upon the recommendation of Pacific Life Fund Advisors LLC, the investment adviser of the Currency StrategiesInternational Equity Income Portfolio, considered and unanimously approved the liquidation of the Currency StrategiesInternational Equity Income Portfolio and agreed to submit the Plan of Liquidation to shareholders for approval.

You are being asked to approve the Plan of Liquidation of the Currency StrategiesInternational Equity Income Portfolio (the “Proposal”). If the Proposal is approved and you have not elected to move your contract/account value to a new investment option prior to the date of liquidation of the Currency StrategiesInternational Equity Income Portfolio, Pacific Life will, upon liquidation, reinvest your contract/account value in Service Class shares of the Fidelity Variable Insurance Products Government Money Market Portfolio.

The Board of Trustees, as well as management of Pacific Life, recommends that you vote “FOR” the Plan of Liquidation.A summary of the Board of Trustees’ considerations in approving the liquidation, as well as other important information, is provided in the enclosed Proxy Statement.

Please read the Proxy Statement and consider it carefully before casting your voting instruction. We appreciate your participation and prompt response in this matter and thank you for your continued support.

Sincerely,

|  |

| James T. Morris | |

President and Chief Executive Officer | Adrian S. Griggs Executive Vice President |

| Chairman of the Board of Directors | |

Pacific Life Insurance Company and Pacific Life & Annuity Company | Chief Operating Officer Pacific Life Insurance Company and Pacific Life & Annuity Company |

700 Newport Center Drive

Post Office Box 7500

Newport Beach, California 92660

Notice of Special Meeting of Shareholders of the Currency StrategiesInternational Equity Income Portfolio

to be Held on April 17,October 23, 2020

Dear Contract Owner:

NOTICE IS HEREBY GIVEN that a Special Meeting of Shareholders (the “Meeting”) of the Currency StrategiesInternational Equity Income Portfolio, a fund of Pacific Select Fund, is scheduled for April 17,October 23, 2020 at 10:30 a.m.12:00 p.m. Pacific Time, at the offices of Pacific Life Insurance Company at 700 Newport Center Drive, Newport Beach, California 92660. We are sensitive to the health and travel concerns our shareholders may have and the restrictions that public health officials have issued in light of the evolving coronavirus (COVID-19) situation. As a result, we may change the location, date and/or time of the Meeting, as well as the format of the Meeting to a telephonic meeting. We plan to announce any such updates on our website (https://www.pacificlife.com/home/pacific-select-fund.html) andbe held telephonically via a press release, and we encourage you to check this website prior to the Meeting if you plan to attend.conference call. The Meeting is being held to consider the following proposals:

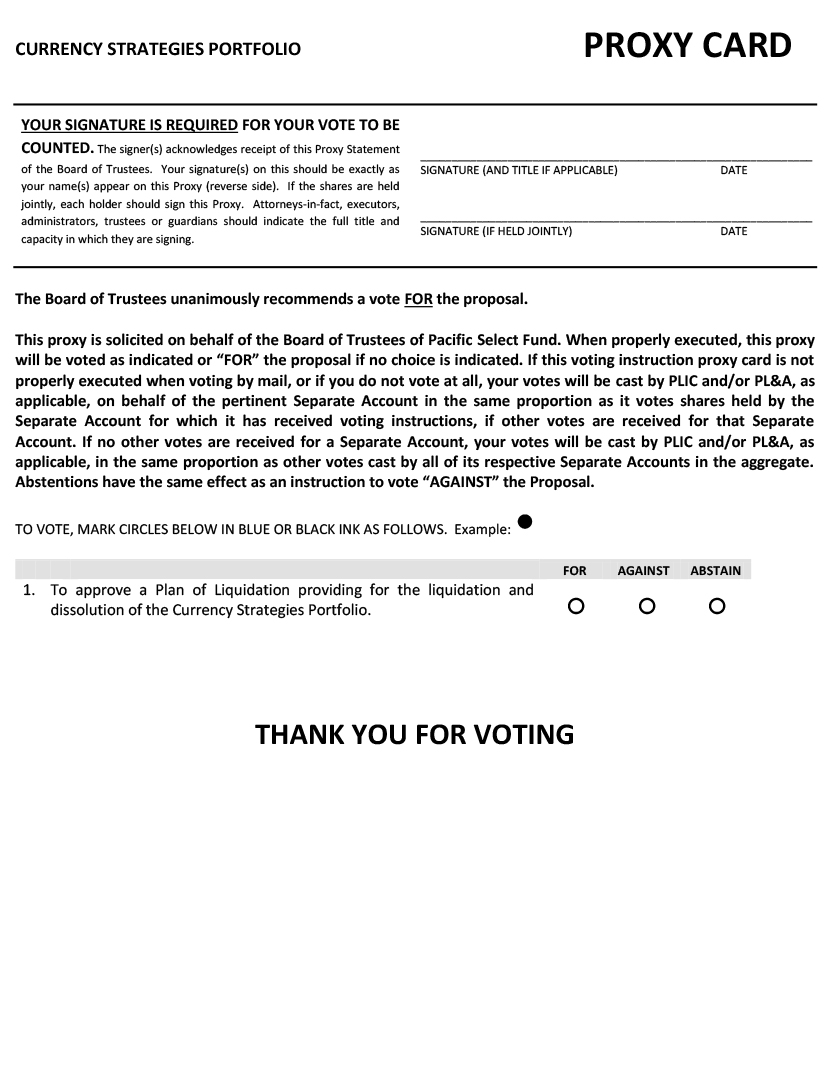

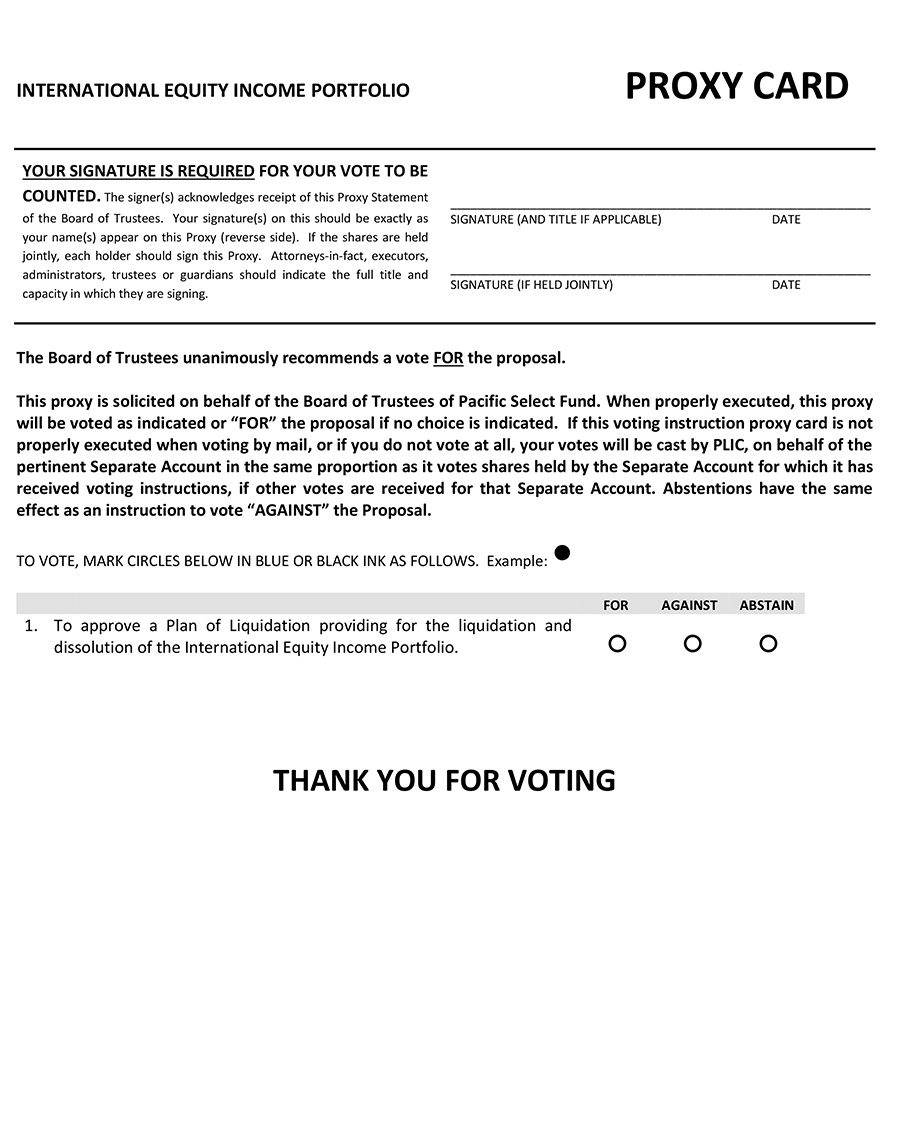

| (1) | To approve a Plan of Liquidation providing for the liquidation and dissolution of the |

| (2) | To transact such other business, not currently contemplated, that may properly come before the Meeting, or any adjournment(s) or postponement(s) thereof, in the discretion of the proxies or their substitutes. |

Shareholders of record at the close of business on February 26,September 18, 2020 (the “Record Date”) are entitled to notice of, and to vote at, the Meeting and any adjournment(s) or postponement(s) thereof. Owners of variable life insurance policies and variable annuity contracts having a beneficial interest in the Currency StrategiesInternational Equity Income Portfolio on the Record Date are entitled to vote as though they are shareholders of the Currency StrategiesInternational Equity Income Portfolio.

Please read the enclosed Proxy Statement carefully for information concerning the proposal to be considered at the Meeting. Please complete, sign, and return the enclosed voting instruction proxy card promptly, vote telephonically by calling the number listed on your proxy ballot or vote on the Internet by logging onto the website listed on your proxy ballot.

The Board of Trustees of Pacific Select Fund unanimously recommends that you vote “FOR” the Proposal. Please respond - your vote is important. Whether or not you plan to attend the Meeting, please vote by mail, telephone or Internet. Voting instructions must be received by 8:00 a.m. Eastern Time (5:00 a.m. Pacific Time) on April 17,October 23, 2020. If you vote by mail, the voting instruction proxy card must be received at the address shown on the enclosed postage paid envelope.

Important Notice Regarding the Availability of Proxy Materials for the Meeting to be Held on October 23, 2020: This Notice and the Proxy Statement are available on the Internet at https://vote.proxyonline.com/pacificselect/docs/internationalequityincomeportfolio2020.pdf.

By Order of the Board of Trustees of Pacific Select Fund

| |

Jane M. Guon

Vice President and Secretary

Pacific Select Fund

October 5, 2020

PROXY STATEMENT

FOR THE LIQUIDATION OF THE CURRENCY STRATEGIESINTERNATIONAL EQUITY INCOME PORTFOLIO

a fund of Pacific Select Fund

March 26,October 5, 2020

INTRODUCTION

This proxy statement (“Proxy Statement”) is being furnished to you in connection with the solicitation of proxies by the Board of Trustees (the “Board”) of Pacific Select Fund (the “Trust”) on behalf of the Currency StrategiesInternational Equity Income Portfolio (the “Liquidating Fund”), a seriesfund of the Trust, to be voted at a special meeting of shareholders to be held on April 17,October 23, 2020 (the “Meeting”). As more fully described in this Proxy Statement, the purpose of the Meeting is for shareholders to consider and to vote on the proposed Plan of Liquidation that would provide for the liquidation and dissolution of the Liquidating Fund (the “Liquidation”). If the proposed Plan of Liquidation (the “Proposal”) is approved and you have not elected to move your contract/account value to a new investment option prior to the Liquidation, Pacific Life (defined below) has informed the Trust that, upon liquidation, your contract/account value will be reinvested in Service Class shares of the Fidelity® Variable Insurance Products Government Money Market Portfolio (the “Fidelity VIP Government Money Market Fund”).

YOU SHOULD READ THIS ENTIRE PROXY STATEMENT CAREFULLY AND REVIEW THE PLAN OF LIQUIDATION, WHICH IS ATTACHED AS APPENDIX A, AS WELL AS THE FIDELITY VIP GOVERNMENT MONEY MARKET FUND’S SUMMARY PROSPECTUS DATED APRIL 30, 2019,28, 2020, WHICH IS BEING PROVIDED TO YOU ALONG WITH THIS PROXY STATEMENT. ALSO, YOU SHOULD CONSULT THE FIDELITY VIP GOVERNMENT MONEY MARKET FUND’S STATUTORY PROSPECTUS AND STATEMENT OF ADDITIONAL INFORMATION (“SAI”), BOTH DATED APRIL 30, 2019,28, 2020, THE SAI AS SUPPLEMENTED, FOR MORE INFORMATION ABOUT THE FIDELITY VIP GOVERNMENT MONEY MARKET FUND.

BACKGROUND

The Liquidating Fund is available as an investment option under variable annuity contracts and variable life insurance policies (the “Contracts”) issued or administered by Pacific Life Insurance Company (“PLIC”) and Pacific Life & Annuity Company (“PL&A” and together with PLIC, “Pacific Life”). Contract owners who selected the Liquidating Fund for investment through a Pacific Life Contract (the “Contract Owners”) have a beneficial interest in the Liquidating Fund, but do not invest directly in or hold shares of the Liquidating Fund. Pacific Life, which uses the Liquidating Fund as a funding vehicle, is the true shareholder of the Liquidating Fund and, as the legal owner of the Liquidating Fund’s shares, has sole voting and investment power with respect to the shares, but passes through any voting rights to Contract Owners. Accordingly, for ease of reference throughout this Proxy Statement, Contract Owners may also be referred to as “shareholders.”

Upon the recommendation of Pacific Life Fund Advisors LLC (the “Adviser”), the Board, including a majority of the Trustees who are not “interested persons” of the Trust, as defined in the Investment Company Act of 1940, as amended (the “Independent Trustees”), considered and approved a Plan of Liquidation for the Liquidating Fund and authorized sending a proxy statement to shareholders of the Liquidating Fund to solicit approval of the Plan of Liquidation.

The Board of Trustees unanimously recommends that Contract Owners of the Liquidating Fund approve the Plan of Liquidation.

THE LIQUIDATION

The Trust is a Delaware statutory trust. The Trust’s Agreement and Declaration of Trust provides that any fund of the Trust may be dissolved at any time by the Trustees by written notice to the shareholders of such fund. Nevertheless, shareholder approval of the Liquidation is being sought for the reasons described in “Summary of the Plan of Liquidation” below.

Reasons for the Liquidation

TheDue to a change in its business plans, the Liquidating Fund’s sub-adviser, Cadence Capital Management LLC, submitted its resignation as sub-adviser to the Liquidating Fund effective at the close of business October 30, 2020. Given the resignation, the Adviser has determined to eliminate its allocations to the Liquidating Fund for those funds of the Trust that seek to achieve their investment goals by investing in other funds of the Trust (the “Allocation Funds”). Given the resignation, the Adviser’s affiliate, which also owns shares of the Liquidating Fund, also has determined to redeem its shares of the Liquidating Fund. The Adviser estimates that after the Allocation Funds redeem their shares of the Liquidating Fund, and after the Adviser’s affiliate redeems its shares, the Liquidating Fund would be left with only approximately $4 million$270,000 in assets. The Liquidating Fund’s co-sub-advisers, UBS Asset Management (Americas) Inc. and Neuberger Berman Investment Advisers LLC, have each indicated that, at that asset size, it would not be able to manage the Liquidating Fund in a manner consistent with its investment strategies. The Adviser does not currently plan to reinvest any assets of the Allocation Funds in the Liquidating Fund nor does it otherwise expect the Liquidating Fund to achieve significant asset growth in the foreseeable future so as to be viable in the long term. Accordingly,Therefore, the Adviser does not plan to seek to engage another sub-adviser to manage the Liquidating Fund. Further, in light of the Liquidating Fund’s extremely low number of contracts and asset level, and the more significant costs associated with a merger compared to a liquidation, the Adviser recommended not to seek a merger with another fund and recommended liquidating the Liquidating Fund.

Approval of the Liquidation

The Adviser advised the Board that it recommends the liquidation of the Liquidating Fund, subject to shareholder approval of a Plan of Liquidation. A Plan of Liquidation was then presented to the Board and approved at a meeting on March 18,September 16, 2020. At that meeting, the Trustees, including a majority of the Independent Trustees, reviewed the recommendation by the Adviser for the Liquidation of the Liquidating Fund, including the information stated above inReasons for the Liquidation, the principal terms and conditions of the Plan of Liquidation, and certain other materials provided by the Adviser regarding the Liquidation. The Independent Trustees had the assistance of their independent counsel during their review.

In approving the proposed Liquidation, the Board considered the following material factors and other factors, including but not limited to, the following:

| (a) | the |

| (b) | given the sub-adviser’s resignation, the Adviser determined to redeem all shares of the Liquidating Fund held by the Allocation Funds and |

| the Adviser does not |

| (c) | the Adviser does not plan to reinvest any assets of the Allocation Funds in the Liquidating Fund nor does it expect the Liquidating Fund to achieve significant asset growth in the foreseeable future so as to be viable in the long term. Therefore, the Adviser does not plan to seek to engage another sub-adviser to manage the Liquidating Fund and recommended liquidating the Liquidating Fund. |

| at the Liquidating Fund’s expected asset size, |

| alternatives to the proposed Liquidation, including the feasibility of merging the Liquidating Fund into another fund of the Trust; |

| the Adviser’s recommendation to liquidate the Liquidating Fund; |

| the terms and conditions of the proposed Plan of Liquidation; |

| any direct or indirect costs to be incurred by the Liquidating Fund and its shareholders (i.e., the brokerage and transaction costs incurred in connection with the sale of the Liquidating Fund’s portfolio holdings) as a result of the proposed Liquidation; and |

| the Adviser will pay the costs (other than brokerage and transaction fees incurred in connection with the sale of the Liquidating Fund’s |

After consideration and discussion of the above and other factors, the Board concluded that such factors supported seeking shareholder approval to liquidate the Liquidating Fund and determined that the proposed liquidation would be in the best interests of the Liquidating Fund’s shareholders. Thus, the Board approved the Plan of Liquidation for the Liquidating Fund, subject to shareholder approval, which is described in further detail below.

SUMMARY OF THE PLAN OF LIQUIDATION

The Plan of Liquidation provides for the liquidation and dissolution of the Liquidating Fund after the close of business on AprilOctober 30, 2020, or such other date as an officer of the Trust shall determine (the “Liquidation Date”). On or before the Liquidation Date, all portfolio securities of the Liquidating Fund will be converted to cash or cash equivalents and the Liquidating Fund will pay, or make reasonable provision to pay, all known or reasonably ascertainable liabilities, claims and obligations of the Liquidating Fund. On the Liquidation Date, the Liquidating Fund’s remaining assets will be distributed ratably among its shareholders of record. Pacific Life has informed the Trust that, unless otherwise instructed, the distributed assets will be immediately reinvested in Service Class shares of the Fidelity VIP Government Money Market Fund. Pacific Life represented to the Board that shareholder approval of the Plan of Liquidation would obviate the need for an order from the U.S. Securities and Exchange Commission (the “SEC”) to substitute a Contract Owner’s interest in the Liquidating Fund with an interest in the Fidelity VIP Government Money Market Fund for any Contract Owners who have not transferred their money out of the Liquidating Fund prior to the Liquidation Date. In order to provide for an orderly liquidation and convert all portfolio securities of the Liquidating Fund to cash or cash equivalents, the Liquidating Fund is expected to deviate from its investment goal and principal investment strategies until it is liquidated on the Liquidation Date. For example, short-term money market or other instruments may be held by the Liquidating Fund in anticipation of its liquidation and these investments will not perform in the same manner as investments held by the Liquidating Fund under normal circumstances.

The Plan of Liquidation is structured so as not to result in any dilution of the interests of any shareholders. All material provisions of the Plan of Liquidation are summarized below; for further information and to review the terms of the Plan of Liquidation, please refer to the Plan of Liquidation inAppendix A.

The Plan of Liquidation may be amended by the Board as may be necessary or appropriate to effect the Liquidation. In addition, the Plan of Liquidation may be abandoned by the Board at any time if it determines that abandonment would be advisable and in the best interests of the Liquidating Fund and its shareholders.

Effect of the Plan of Liquidation

The Plan of Liquidation iswill not expected to affect the value of your interest in your Contract. Prior to the proposed Liquidation, Contract Owners may transfer their assets to one or more of the other investment options available under their Contracts and a Contract Owner will receive an interest in thatsuch investment optionoption(s) having the same value as the value of the shares of the Liquidating Fund beneficially owned by that Contract Owner immediately prior to the transfer. If the Plan of Liquidation is approved and a Contract Owner has not selected a new investment option prior to the Liquidation Date, the Contract Owner will beneficially own, immediately after the Liquidation, a number of Service Class shares of the Fidelity VIP Government Money Market Fund having the same value as the value of the shares of the Liquidating Fund beneficially owned by that Contract Owner immediately prior to the Liquidation. After the Liquidation, such Contract Owners will indirectly bear the fees and expenses of the Service Class shares of the Fidelity VIP Government Money Market Fund, but the Liquidation will not result in any change to a Contract Owner’s Contract fees or charges. Following the Liquidation, the Liquidating Fund will hold no assets and be dissolved.

Expenses of the Liquidation

The Adviser will bear the expenses of the Liquidation, which are estimated to be approximately $26,415$21,600 and include the costs related to this Proxy Statement such as preparation of thisthe Proxy Statement, printing and distributing the proxy materials, the costs of soliciting and tallying voting instructions, the cost of any necessary filings with the SEC, legal fees, and expenses of holding shareholder meetings. The Liquidating Fund will bear any brokerage fees and other transaction costs associated with the sale of portfolio holdings of the Liquidating Fund prior to the Liquidation as a result of the Liquidation, along with any usual and customary expenses of the Liquidating Fund such as accounting, custody and Trustees’ fees; and the Fidelity VIP Government Money Market Fund will bear any brokerage fees and other transaction costs associated with the purchase of portfolio holdings by the Fidelity VIP Government Money Market Fund after the Liquidation as a result of cash in-flows from the Liquidation.

Tax considerations: The Liquidation will be a non-taxable event for Contract Owners.

Implementation of the Plan of Liquidation should not cause the Contract Owners who invest in the Liquidating Fund or the Fidelity VIP Government Money Market Fund to recognize any gain or loss for Federal income tax purposes from the transactions contemplated by the Plan of Liquidation.

Information about the Fidelity VIP Government Money Market Fund

The Fidelity VIP Government Money Market Fund’s Summary Prospectus dated April 30, 2019,28, 2020, is being provided to you along with this Proxy Statement. For further information, please refer to the Fidelity VIP Government Money Market Fund’s Statutory Prospectus and SAI, both dated April 30, 2019,28, 2020, the SAI as supplemented.

Selection of the Fidelity VIP Government Money Market Fund as the “default” investment option

Pacific Life selected the Fidelity VIP Government Money Market Fund as the fund into which it will move a Contract Owner’s account value if the Contract Owner has not elected to move his or her contract/account value to a new investment option prior to the date of liquidation of the Liquidating Fund. Pacific Life selected the Fidelity VIP Government Money Market Fund because it is the only money market investment option available to all affected Pacific Life Contract Owners. Pacific Life may be faced with potential conflicts of interest relating to its selection of the Fidelity VIP Government Money Market Fund and its Service Class shares (seePotential benefits to the Adviser and its Affiliates section below for further information). Since selection of a default investment option is an insurance company matter, neither the Trust’s Board nor the Trust’s Adviser has any role or responsibility with respect to its selection. A Contract Owner, working with their financial professional, should consider transferring from the Fidelity VIP Government Money Market Fund to other investment options available under his or her contract which are more consistent with the Contract Owner’s investment goals and objectives.

Potential benefits to the Adviser and its Affiliates

The Adviser or its affiliates may realize benefits as a result of the investment in the Fidelity VIP Government Money Market Fund and therefore may be faced with potential conflicts of interest relating to Pacific Life’s selection of the Fidelity VIP Government Money Market Fund Service Class shares as the default investment option. In that regard, it should be noted that an affiliate of Pacific Life will be paid by the distributor of the Fidelity VIP Government Money Market Fund a fee at an annual rate of up to 0.10% of the average daily net assets of Contracts invested in the Fidelity VIP Government Money Market Fund for providing various services to shareholders pursuant to the Fidelity VIP Government Money Market Fund’s Distribution and Service Plan. Currently, the Liquidating Fund pays up to 0.20% of its average daily net assets to broker-dealers that provide various services to shareholders. In addition, the transfer agent for the Fidelity VIP Government Money Market Fund will pay Pacific Life a fee for providing certain services that the transfer agent would otherwise provide. The fee for providing such services is an annual rate of 0.05%, payable quarterly and based on each quarter’s average daily assets held by Contract Owners, with a maximum payment of $1 million per quarter.

The Liquidating Fund’s expenses are currently capped through an agreement with the Adviser, which agreement terminates on April 30, 2021. If the Liquidation occurs on or about October 30, 2020 as proposed, the Adviser will not bear the expense of those expense cap payments from October 31, 2020 through April 30, 2021 which are estimated to be approximately $15,000.

Purchases and transfers into the Liquidating Fund

PurchasesEffective October 19, 2020, purchases and transfers into the Liquidating Fund will not be accepted effective April 1, 2020 for new or existing owners offrom Pacific Life variable life insurance policies issued by PLIC and PL&A. Purchases and transfers intoannuity Contract Owners who are not already invested in the Liquidating Fund will not be accepted effective April 1, 2020 for new ownersas of this date. Pacific Life variable annuity contracts issued by PLIC and PL&A. Existing owners of variable annuity contracts issued by PLIC and PL&A thatContract Owners who are invested in the Liquidating Fund as of the close of business on October 16, 2020 may make purchases or transfers into the Liquidating Fund until the Liquidation Date.

Future allocation of premiums will be treated as orders for the Fidelity VIP Government Money Market Fund

Pacific Life has advised the Trust that once the Liquidation is approved and completed, all orders associated with new premiums or transfers (purchase and redemption requests) for the Liquidating Fund will be deemed a request for the purchase or redemption of Service Class shares of the Fidelity VIP Government Money Market Fund.

Transfers out of the Liquidating Fund

Shareholders may transfer out of the Liquidating Fund into any other investment option available under their respective Contracts at any time up until the Liquidation Date. Shareholders may obtain the current prospectus and SAI for any of the investment options underlying their Contracts by going to www.PacificLife.com or by calling a customer service representative using the applicable phone numbers listed in theAnnual and Semi-Annual Reports section of this Proxy Statement. Pacific Life has informed the Trust that any shares of the Liquidating Fund held at the close of business on the Liquidation Date will automatically be reinvested in Service Class shares of the Fidelity VIP Government Money Market Fund. Pacific Life has also informed the Trust that transfers out of the Liquidating Fund within 30 days prior to the Liquidation Date and transfers out of the Fidelity VIP Government Money Market Fund within 3090 days after the Liquidation Date will not count as a transfer for purposes of transfer limitations under the Contracts. As such, there will be no charge or cost associated with these transfers. Pacific Life has confirmed to the Trust that it will issue supplements to the prospectuses for its affected Contracts advising Contract Owners of their rights to transfer under their respective Contracts. You may obtain a Transfers & Allocation Form from a customer service representative or you can make a transfer directly with a customer service representative using the applicable phone numbers listed in theAnnual and Semi-Annual Reports section of this Proxy Statement.

If the Proposal is not approved

If shareholders of the Liquidating Fund do not approve the Plan of Liquidation, the Plan of Liquidation will not be implemented. However, the Adviser has advised the Board that the Allocation Funds will redeem all of their shares of the Liquidating Fund by the Liquidation Date, which will leave the Liquidating Fund with only approximately $4 million in assets and, at that expected asset size, each co-sub-adviser of the Liquidating Fund would not be able to manage the Liquidating Fund in a manner consistent with its investment strategies. Accordingly, ifIf the Plan of Liquidation is not approved, beginning October 31, 2020, PLFA will manage the day-to-day investments of the Liquidating Fund will likely be invested in cash and cash instruments and the Board would then meet to consider what, if any, additional steps to take with respect to the Liquidating Fund. Pacific Life has advised the Board that if the Plan of Liquidation is not approved, it may seek an orderThose steps might include seeking regulatory relief from the SEC to permit Pacific Life to substitute each remaining Contract Owner’s interest in the Liquidating Fund with an interest in the Fidelity VIP Government Money Market Fund.Fund without approval from Contract Owners.

GENERAL INFORMATION

Solicitation of proxies

The principal solicitation will be by mail, but voting instructions also may be solicited by telephone, internet or in person.telephone. AST Fund Solutions LLC has been retained to assist with voting instruction solicitation activities (including assembly and mailing of materials to Contract Owners). All expenses incurred in connection with the preparation of this Proxy Statement and the solicitation of instructions will be paid by the Adviser. AST Fund Solutions LLC will be paid approximately $7,315$3,250 for printing and mailing proxy materials, tabulating votes and estimated proxy solicitation fees.

Voting rights

Holders of shares of the Liquidating Fund at the close of business on February 26,September 18, 2020 (the “Record Date”) are entitled to one vote for each share held, and a proportionate fraction of a vote for each fraction of a share held.

Class I. PLIC and PL&A areis the sole shareholdersshareholder of Class I of the Liquidating Fund entitled to vote. PLIC and PL&A holdholds Class I shares of the Liquidating Fund in their respectiveits “Separate Accounts,Account,” which areis an investment accountsaccount established specifically to support obligations of the Contracts.Contracts, and directly. The assets and liabilities of the Separate AccountsAccount are segregated from PLIC’s and PL&A’s general account assets and liabilities. PLIC’s and PL&A’s voting rights are being passed on to you as a Contract Owner, allowing you to provide voting instructions that will be followed when votes are cast by PLIC and PL&A at the Meeting. The number of shares for which such instruction may be given for purposes of voting at the Meeting, including any postponements or adjournments thereof, will be determined as of the Record Date.

Class P. Certain Allocation Funds are the sole shareholders of Class P of the Liquidating Fund entitled to vote. Each Allocation Fund will vote its proxies for the Proposal in the same proportion as the vote of all other shareholders of the Liquidating Fund (namely, the Class I shareholders of the Liquidating Fund). The number of shares for which such instruction may be given for purposes of voting at the Meeting, including any postponements or adjournments thereof, will be determined as of the Record Date.

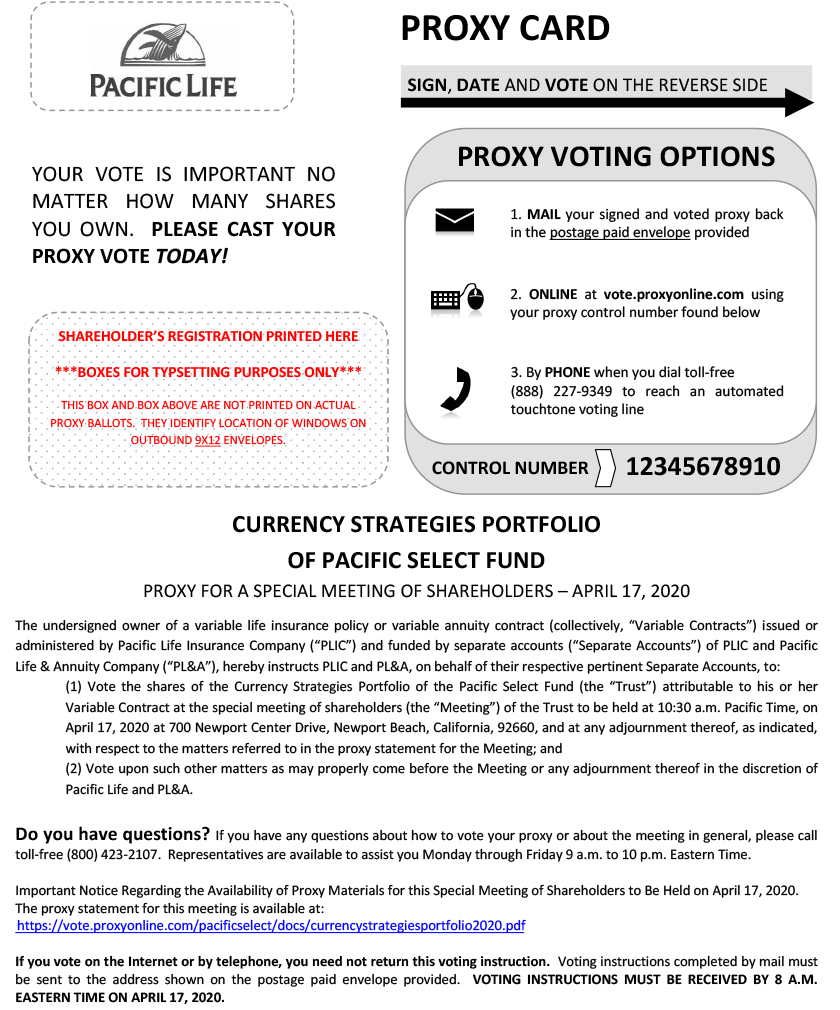

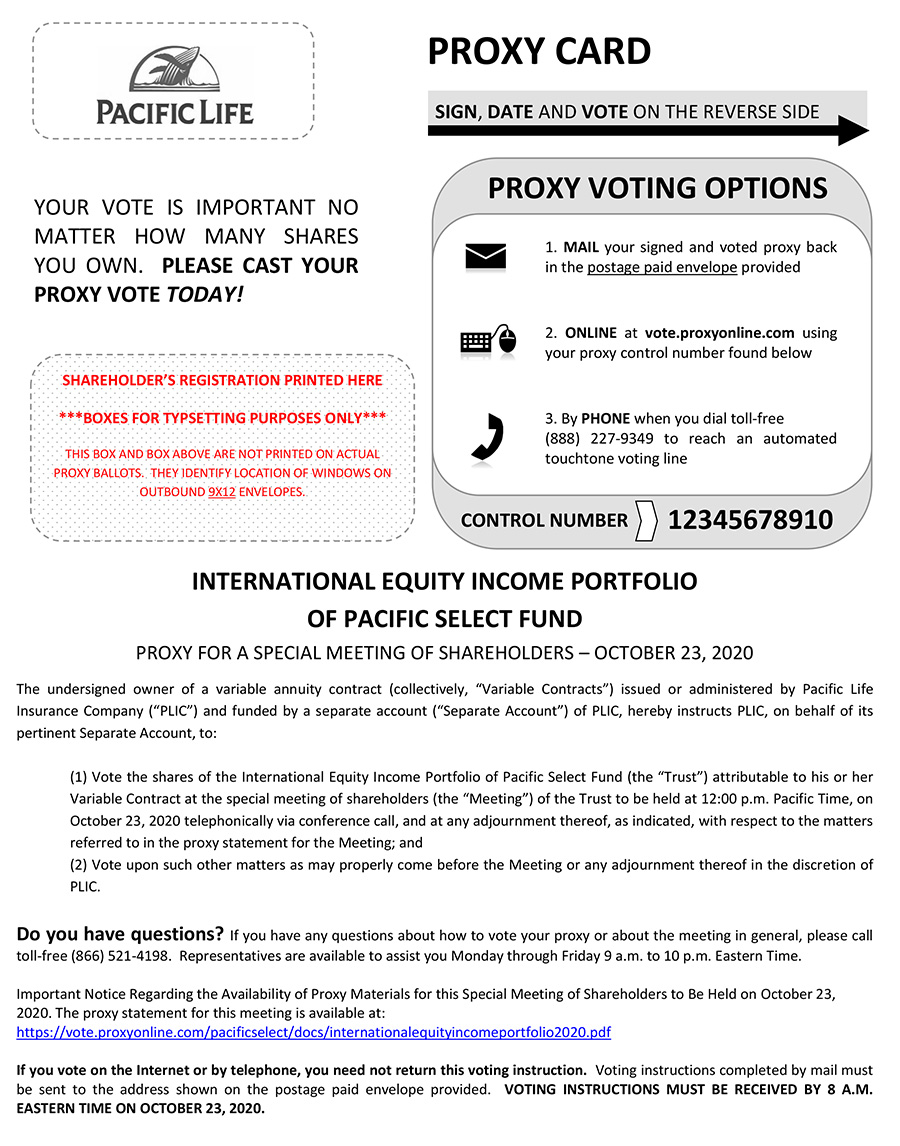

Voting options

Contract Owners may vote by mail, telephone or internet in advance of the Meeting or in personby internet at the telephone conference Meeting. To attend the Meeting in person, you will be required to provide proof of ownership of an interest in the Liquidating Fund and a valid form of identification, such as a driver’s license, passport or other government-issued identification. Voting instructions, whether submitted via mail, telephone or internet, must be received by 8:00 a.m. Eastern Time (5:00 a.m. Pacific Time) on the Meeting Date or properly submitted at the Meeting in personaccordance with instructions which will be provided at the Meeting. If you vote by mail, the voting instruction proxy card (“proxy card”) must be properly executed (signed by all Contract Owners of record) and received at the address shown on the enclosed postage paid envelope.

For those planning to attend the telephone conference Meeting, please email AST at attendameeting@astfinancial.com in advance of the meeting and provide us with your full name, control number and mailing address in order to receive the conference call dial-in information. Voting at the Meeting will be conducted via the internet during the Meeting. If you plan to vote at the Meeting, you will need to log onto www.vote.proxyonline.com.

Contract Owners may revoke a previously submitted proxy card at any time prior to its use by providing PLIC or PL&A, as applicable, with a written revocation or duly executed proxy card bearing a later date. In addition, any Contract Owner who attends the Meeting in person may vote by ballotinternet at the Meeting, thereby canceling any voting instruction previously given.

How PLIC and PL&A will vote at the Meeting

| (i) | If you provide voting instructions timely (on a properly executed proxy card if you are voting by mail), PLIC |

| (ii) | If you provide a properly executed proxy card timely, but it does not include voting instructions, PLIC |

| (iii) | If you provide voting instructions timely to ABSTAIN, the instruction will be counted as present for purposes of determining whether a quorum of shares is present at the Meeting and PLIC |

| (iv) | If you do not provide voting instructions timely (and have not provided a properly executed proxy card), PLIC |

As a result of the proportional voting described in paragraphsparagraph (iv) and (v) above and in the “Class P” paragraph under theVoting Rights section above, a small number of Contract Owners may determine the outcome of the vote.

The Board of Trustees unanimously recommends that you vote “FOR” the proposed Plan of Liquidation.

Ownership of Shares of the Liquidating Fund

With respect to Class I shares of the Liquidating Fund. As of the close of business on the Record Date, there were 371,314.82436,608.310 Class I shares of the Liquidating Fund outstanding. To the knowledge of the Trust, as of the Record Date, no current Trustee owns 1% or more of the outstanding Class I shares of the Liquidating Fund, and the officers and Trustees of the Liquidating Fund own, as a group, less than 1% of the shares of the Liquidating Fund.

With respect to Class P shares of the Liquidating Fund. As of the close of business on the Record Date, there were 70,601,676.08550,129,840.148 Class P shares of the Liquidating Fund outstanding. Class P shares of the Liquidating Fund are not available for investment to officers and Trustees of the Liquidating Fund.

The following table, entitled “Principal Holders of Fund Shares,” provides the shareholders of record (or shareholders known by the Trust to own beneficially) that owned more than 5% of the Liquidating Fund’s share classes, as of the Record Date.

| Class Name | Name and Address of Beneficial Owner | Number of Shares Owned | Percent of Class Owned | Name and Address of Beneficial Owner | Number of Shares Owned | Percent of Class Owned |

| Class I | Pacific Select Exec Separate Account of PLIC | 78,042.278 | 21.02% | |||

| Class I | Separate Account A of PLIC | 271,128.733 | 73.02% | Separate Account A of Pacific Life Insurance Company | 30,265.658 | 82.674% |

| Class I | Separate Account A of PL&A | 20,120.783 | 5.42% | Pacific Life Insurance Company | 6,342.652 | 17.326% |

| Class P | Portfolio Optimization Conservative Portfolio | 5,982,484.761 | 8.47% | Portfolio Optimization Moderate-Conservative Portfolio | 3,657,483.960 | 7.296% |

| Class P | Portfolio Optimization Moderate-Conservative Portfolio | 9,286,366.090 | 13.15% | Portfolio Optimization Moderate Portfolio | 17,160,588.847 | 34.232% |

| Class P | Portfolio Optimization Moderate Portfolio | 29,192,683.333 | 41.35% | Portfolio Optimization Growth Portfolio | 21,930,596.758 | 43.748% |

| Class P | Portfolio Optimization Growth Portfolio | 21,270,856.534 | 30.13% | Portfolio Optimization Aggressive-Growth Portfolio | 6,548,169.857 | 13.062% |

| Class P | Portfolio Optimization Aggressive-Growth Portfolio | 4,869,285.367 | 6.90% | |||

PLIC could be deemed to control the voting securities of Class I of the Liquidating Fund (i.e., by owning more than 25% of Class I of the Liquidating Fund in its Separate Account A)Fund). However, since PLIC would exercise voting rights attributable to Class I shares of the Liquidating Fund owned by it based on voting instructions received from its Contract Owners as noted above, PLIC will not control the outcome of the vote.

The Portfolio Optimization Moderate Portfolio and the Portfolio Optimization Growth Portfolio each could be deemed to control the voting securities of Class P of the Liquidating Fund (i.e., by owning more than 25% of Class P of the Liquidating Fund). However, since these Allocation Funds would exercise voting rights attributable to Class P shares of the Liquidating Fund owned by them in the same proportion as the vote of all other shareholders of the Liquidating Fund (namely, the Class I shareholders of the Liquidating Fund), these Allocation Funds will not control the outcome of the vote.

PLIC is a Nebraska domiciled life insurance company and a subsidiary of Pacific LifeCorp, a holding company, which in turn is a subsidiary of Pacific Mutual Holding Company, a mutual holding company. PL&A is an Arizona domiciled life insurance company and a subsidiary of PLIC/PL&A.PLIC. PLIC and PL&A’s principal offices are located at 700 Newport Center Drive, Newport Beach, CA 92660.

Quorum

The Liquidating Fund must have a quorum to conduct its business at the Meeting. Holders of 30% of the outstanding shares of the Liquidating Fund present in person or by proxy shall constitute a quorum. Any lesser number shall be sufficient for adjournments. Shares held by shareholders present in person or represented by proxy at the Meeting (including PLIC and PL&A)PLIC) will be counted both for the purpose of determining the presence of a quorum and for calculating the votes cast on any proposal before the Meeting. Since PLIC and PL&A areis the ownersowner of record of a majority of the outstanding shares of the Class I shares of the Liquidating Fund, and certain Allocation Funds of the Trust are the beneficial owners of the outstanding shares of the Class P shares of the Liquidating Fund, it is anticipated that a quorum will be present at the Meeting.

Required Vote

Approval of the Plan of Liquidation requires the vote of a majority of the outstanding voting securities (as defined in the Investment Company Act of 1940, as amended (the “1940 Act”)) of the Liquidating Fund to vote “FOR” the approval of the Proposal. Under the 1940 Act, the vote of “a majority of the outstanding voting securities” of the Liquidating Fund means the vote at a duly called meeting: (1) of 67% or more of the voting securities of the Liquidating Fund that are present at the Meeting, if the holders of more than 50% of the outstanding voting securities of the Liquidating Fund are present or represented by proxy; or (2) of more than 50% of the outstanding voting securities of the Liquidating Fund, whichever is less. This is a fund-wide vote, meaning that all classes (Class I and Class P) of the Liquidating Fund will vote together, and vote results will be considered at the Liquidating Fund level without regard to share class.

Investment Adviser, Principal Underwriter and AdministratorAdministrators

Pacific Life Fund Advisors LLC (“PLFA”), a Delaware limited liability company and wholly-owned subsidiary of PLIC, serves as investment adviser to the Liquidating Fund pursuant to an investment advisory agreement with the Trust. PLFA employs UBS AssetCadence Capital Management (Americas) Inc. and Neuberger Berman Investment Advisers LLC as co-sub-advisers for and portfolio managerssub-adviser to the Liquidating Fund, pursuant to a sub-advisory agreements.agreement.

8

Pacific Select Distributors, LLC serves as the Liquidating Fund’s principal underwriter and distributor pursuant to a Distribution Agreement with the Trust.

PLIC serves as the administratorand PLFA provide administrative and support services to the Liquidating Fund pursuant to an Administration and Support Services Agreement with the Trust.

The investment adviser, principal underwriter and distributor and administratoradministrators are all located at 700 Newport Center Drive, Newport Beach, California 92660.

Annual and Semi-Annual Reports

The Trust’s annual report for the fiscal year ended December 31, 2019 and its semi-annual report for the period ended June 30, 20192020 were previously sent to shareholders and are available online atwww.PacificLife.com/PacificSelectFund.htm. The annual report and the semi-annual report are available upon request without charge by contacting the Trust by:

| Regular mail: | Pacific Select Fund, P.O. Box 7500, Newport Beach, CA 92660 |

| Telephone: | PLIC’s Annuity Contract Owners: 1-800-722-4448 (6 a.m. through 5 p.m. Pacific Time, Monday through Friday) |

PLIC’s Annuity Financial Professionals: 1-800-722-2333 (6 a.m. through 5 p.m. Pacific Time, Monday through Friday) | |

| Electronic mail: | |

Electronic mail: PSFdocumentrequest@pacificlife.com

Other matters to come before the Meeting

The Trust does not know of any matters to be presented at the Meeting other than those described in this Proxy Statement. If other business should properly come before the Meeting, PLIC and PL&A will vote thereon in accordance with their respective best judgment.

Shareholder proposals

The Liquidating Fund is not required to hold regular annual meetings and, in order to minimize its costs, does not intend to hold meetings of shareholders unless so required by applicable law, regulation, regulatory policy or if otherwise deemed advisable by the Liquidating Fund’s management. Therefore, it is not practicable to specify a date by which shareholder proposals must be received in order to be incorporated in an upcoming proxy statement for an annual meeting.

PLEASE:

| PROMPTLY EXECUTE AND RETURN THE ENCLOSED VOTING INSTRUCTION PROXY CARD. A SELF-ADDRESSED, POSTAGE-PAID ENVELOPE IS ENCLOSED FOR YOUR CONVENIENCE. |

OR

| VOTE TELEPHONICALLY BY CALLING |

OR

| VOTE ON THE INTERNETBY LOGGING ONTOWWW.VOTE.PROXYONLINE.COM AND FOLLOWING THE ONLINE INSTRUCTIONS. |

VOTING INSTRUCTIONS MUST BE RECEIVED BY 8:00 A.M. EASTERN TIME (5:00 A.M. PACIFIC TIME) ON APRIL 17,OCTOBER 23, 2020. VOTES CAST BY MAIL NEED TO BE RECEIVED AT THE ADDRESS SHOWN ON THE ENCLOSED POSTAGE PAID ENVELOPE.

OR

| VOTE |

| ||

| Jane M. Guon | ||

| Vice President and Secretary | ||

| Pacific Select Fund |

March 26,October 5, 2020

APPENDIX A

PACIFIC SELECT FUND

CURRENCY STRATEGIES

INTERNATIONAL EQUITY INCOME PORTFOLIO

PLAN OF LIQUIDATION

The following Plan of Liquidation (“Plan”) of the Currency StrategiesInternational Equity Income Portfolio (“Liquidating Fund”), a seriesfund of Pacific Select Fund, (“Trust”) organized and existing under the laws of the State of Delaware, and an open-end management investment company registered under the Investment Company Act of 1940, as amended (“1940 Act”), is intended to accomplish the complete liquidation and termination of the Liquidating Fund (“Liquidation”) in conformity with the laws of the State of Delaware, the 1940 Act, the Internal Revenue Code of 1986, as amended (“Code”), and the Trust’s Agreement and Declaration of Trust and By-Laws.

WHEREAS, on March 18,September 16, 2020, the Trust’s Board of Trustees (“Board”) determined that it is in the best interests of the Liquidating Fund and its shareholders to liquidate the Liquidating Fund after considering the following material factors and other factors, including but not limited to, the following:

| (a) | the |

| (b) | given the sub-adviser’s resignation, the Adviser determined to redeem all shares of the Liquidating Fund held by certain funds of the Trust which seek to achieve their goals by investing in other funds of the Trust (“Allocation Funds”) |

| (c) | the Adviser does not plan to reinvest any assets of the Allocation Funds in the Liquidating Fund nor does it expect the Liquidating Fund to achieve significant asset growth in the foreseeable future so as to be viable in the long term. Therefore, the Adviser does not plan to seek to engage another sub-adviser to manage the Liquidating Fund and recommended liquidating the Liquidating Fund. |

| (d) | at the Liquidating Fund’s expected asset size, |

| alternatives to the proposed Liquidation, including feasibility of merging the Liquidating Fund into another fund of the Trust; |

| the Adviser’s recommendation to liquidate the Liquidating Fund; |

| the terms and conditions of the proposed Plan; |

| any direct or indirect costs to be incurred by the Liquidating Fund and its shareholders as a result of the proposed |

| the Adviser will pay the costs (other than brokerage and transaction fees incurred in connection with the sale of the Liquidating Fund’s |

WHEREAS, the Board has determined that it is advisable and in the best interests of the Liquidating Fund and its shareholders to liquidate the Liquidating Fund on or about Aprilthe close of business October 30, 2020 or such other date as determined by any officer of the Trust (“Liquidation Date”); and

WHEREAS, on March 18,September 16, 2020, the Board unanimously approved this Plan as being in the best interests of the Liquidating Fund and its shareholders and adopted this Plan as the method of liquidating the Liquidating Fund.

NOW, THEREFORE, the liquidation of the Liquidating Fund shall be carried out in the manner hereinafter set forth:

1. EFFECTIVE DATE OF PLAN.The Plan shall become effective immediately after the close of business on AprilOctober 30, 2020, or such other date as determined by any officer of the Trust (hereinafter, “Effective Date”).

2. NOTICE TO SHAREHOLDERS OF LIQUIDATION.Prior to the Effective Date, the Liquidating Fund shall provide notice to shareholders to the effect that this Plan has been approved by the Board and that on the Liquidation Date, all outstanding shares of the Liquidating Fund shall be liquidated.

3. CESSATION OF BUSINESS.On or before the Effective Date, the Liquidating Fund shall not engage in any business activities except for the purposes of winding down its business and affairs, preserving the value of its assets, and distributing its remaining assets ratably among the shareholders of the outstanding shares of the Liquidating Fund, in accordance with the provisions of the Plan, after discharging or making reasonable provision for the Liquidating Fund’s liabilities.

4. RESTRICTION OF SALE OF LIQUIDATING FUND SHARES. If the Plan is approved, noEffective October 19, 2020, purchases orand transfers into the Liquidating Fund will not be accepted effective April 1, 2020 for new or existing contract owners of variable life insurance policies issued byfrom Pacific Life Insurance Company and Pacific Life & Annuity Company. No purchases or transfers intovariable annuity Contract Owners who are not already invested in the Liquidating Fund will be accepted effective April 1, 2020 for new contract ownersas of this date. Pacific Life variable annuity contracts issued by Pacific Life Insurance Company and Pacific Life & Annuity Company. Existing contract owners of variable annuity contracts issued by Pacific Life Insurance Company and Pacific Life & Annuity Company thatContract Owners who are invested in the Liquidating Fund as of the close of business on October 16, 2020 may make purchases or transfers into the Liquidating Fund until the Liquidation Date.

5. LIQUIDATION OF ASSETS.On or before the Liquidation Date, the Liquidating Fund shall convert all portfolio securities of the Liquidating Fund to cash or cash equivalents.

6. SATISFACTION OF FEDERAL INCOME AND EXCISE TAX DISTRIBUTION REQUIREMENTS.On or before the Liquidation Date, any officer of the Trust shall declare and pay a dividend or dividends which, together with all previous such dividends, shall have the effect of distributing to the Liquidating Fund’s shareholders all of the Liquidating Fund’s net tax exempt income and investment company taxable income attributable to the Liquidating Fund for the taxable years ending at or prior to the Liquidation Date (computed without regard to any deduction for dividends paid), and all of the Liquidating Fund’s net capital gain, if any, realized in the taxable years ending at or prior to the Liquidation Date (after reduction for any available capital loss carry-forward) and any additional amounts necessary to avoid any excise tax for such periods.

7. PAYMENT OF DEBTS.On or before the Liquidation Date, the Liquidating Fund shall pay, or make reasonable provision to pay, in full, all known or reasonably ascertainable liabilities, claims and obligations, including, without limitation, all contingent, conditional or unmatured claims and obligations, known to the Liquidating Fund and all claims and obligations which are known to the Liquidating Fund but for which the identity of the claimant is unknown. Such amounts shall include, without limitation, all charges, taxes and expense of the Liquidating Fund, whether due, accrued or anticipated, that have been incurred or are expected to be incurred by the Liquidating Fund.

A-2

8.7. LIQUIDATING DISTRIBUTION.On the Liquidation Date, the Liquidating Fund shall distribute to its shareholders of record as of the close of business on the Liquidation Date, all of the remaining assets of the Liquidating Fund in complete cancellation and redemption of all the outstanding shares of the Liquidating Fund (“Liquidation Proceeds”), except for cash, bank deposits or cash equivalents in an estimated amount necessary to (i) discharge any unpaid liabilities and obligations of the Liquidating Fund on the Liquidating Fund’s books on the Liquidation Date, including, but not limited to, income, dividends and capital gains distributions, if any, payable through the Liquidation Date, and (ii) pay such contingent liabilities as the Board shall reasonably deem to exist against the assets of the Liquidating Fund on the Liquidating Fund’s books; provided further, for the avoidance of doubt, notwithstanding anything herein to the contrary, all interests, rights and titles to any claims, whether absolute or contingent, known or unknown, accrued or unaccrued and including, without limitation any interest in pending or future legal claims in connection with past or present portfolio holdings, whether in the form of class action claims, opt-out or other direct litigation claims, or regulator or government-established investor recovery claims of the Liquidating Fund shall be disclaimed, and any and all resulting recoveries shall be returned to the Trust, and shall not be distributed to the Liquidating Fund’s shareholders of record. With respect to Class I shares of the Liquidating Fund, the Trust will take instruction from Pacific Life Insurance Company and Pacific Life & Annuity Company regarding the allocation of the Liquidation Proceeds to another investment option available to the contract owners, which each of Pacific Life Insurance Company and Pacific Life & Annuity Company has indicated will be the Fidelity Variable Insurance Products Government Money Market Portfolio - Service Class shares.

9.8. LIQUIDATION.The Liquidating Fund shall be liquidated on the Liquidation Date in accordance with Section 331 of the Code. As soon as practicable after the Liquidation Date, the Liquidating Fund shall be terminated.

10.9. MANAGEMENT AND EXPENSES OF THE LIQUIDATING FUND.The Adviser shall bear the expenses incurred related to implementing the Plan of Liquidation, including the costs of the proxy statement sent to Liquidating Fund shareholders such as the costs of preparing the proxy statement, printing and distributing the proxy materials, soliciting and tallying voting instructions, any necessary filings with the U.S. Securities and Exchange Commission, legal fees, and expenses of holding shareholder meetings. The Liquidating Fund will bear any brokerage fees and other transaction costs associated with the sale of portfolio holdings of the Liquidating Fund prior to the Liquidation as a result of the Liquidation, along with any usual and customary expenses of the Liquidating Fund such as accounting, custody and Trustees’ fees.

11.10. RECEIPT OF CASH OR OTHER DISTRIBUTIONS AFTER THE LIQUIDATION DATE.Following the Liquidation Date, if the Liquidating Fund receives any form of cash or is or becomes entitled to any other distributions that it had not recorded on its books on or before the Liquidation Date, any such cash or distribution will be allocated first to reimburse the Adviser for any expenses it incurs pursuant to Paragraph 109 above and then to the Trust in such manner as any officer of the Trust determines is reasonable (and, as a point of clarification, such proceeds mayneed not be distributed to the separate accountsaccount that previously held Liquidating Fund shares or to contract owners who previously allocated to the Liquidating Fund and may instead be used to pay general expenses of the Trust).

12.11. LOST SHAREHOLDERS.If the Trust is unable to pay redemption proceeds to shareholders of the Liquidating Fund because of the inability to locate shareholders to whom redemption proceeds are payable, the Trust may take such steps as an authorized officer of the Trust deems appropriate, which may include creating, in the name and on behalf of the Liquidating Fund, a trust or account with a financial institution and, subject to applicable abandoned property laws, deposit any remaining assets of the Liquidating Fund in such trust for the benefit of the shareholders that cannot be located. The expense of such trust shall be charged against the assets therein.

13.12. POWER OF THE BOARD AND TRUST OFFICERS.The Board and officers of the Trust shall have the authority to do or authorize any acts and things as provided for in the Plan and as they may consider necessary or desirable to carry out the purposes of the Plan, including the execution and filing of certificates, documents, information returns, tax returns and other papers that may be necessary or appropriate to implement the Plan or that may be required by the provisions of the 1940 Act or other applicable laws. The death, resignation or disability of any Trustee or any officer of the Trust shall not impair the authority of the surviving or remaining Trustees or officers to exercise any of the powers provided for in the Plan.

14.13. AMENDMENT OR ABANDONMENT OF PLAN AND SHAREHOLDER APPROVAL OF PLAN.The Board shall have the authority to authorize or ratify such variations from or amendments of the provisions of the Plan as may be necessary or appropriate to effect the liquidation of the Liquidating Fund, and the distribution of its net assets to shareholders in accordance with the laws of the State of Delaware, the 1940 Act, the Code, and the Trust’s Declaration of Trust and By-Laws, if the Board determines that such action would be advisable and in the best interests of the Liquidating Fund and its shareholders. If any amendment or modification appears necessary and in the judgment of the Board will materially and adversely affect the interests of the Liquidating Fund shareholders, Liquidating Fund shareholders will be given prompt and timely notice of such an amendment or modification. In addition, the Board may abandon this Plan at any time if it determines that abandonment would be advisable and in the best interests of the Liquidating Fund and its shareholders. This Plan shall be deemed abandoned in the event the Liquidating Fund’s shareholders do not approve the Plan by the close of business on OctoberDecember 31, 2020.

15.14. CHANGES TO PLAN. Each officer of the Trust may modify or extend any of the dates specified in the Plan for the taking of any action in connection with the implementation of the Plan (including, but not limited to, the Effective Date and the Liquidation Date) or make such other changes as permitted under the law if such officer(s) determine, with the advice of the Trust'sTrust’s General Counsel or his or her delegee, that such modification or extension is necessary or appropriate in connection with the orderly liquidation of the Liquidating Fund or to protect the interests of the shareholders of the Liquidating Fund.

16.15. NO PERSONAL OBLIGATIONS.The obligation of the Trust entered into in the name or on behalf of the Trust or Liquidating Fund by any of the Trustees of the Trust, representatives or agents of the Trust are made not individually, but only in such capacities, and are not binding upon any of the Trustees of the Trust, shareholders or representatives of the Trust personally, but bind only the assets of the Trust attributable to the Liquidating Fund.

17.16. GOVERNING LAW.This Plan shall be governed by and construed in accordance with the laws of the State of Delaware without regard to its principles of conflicts of laws.

IN WITNESS WHEREOF, the Board has caused this Plan to be approved on behalf of the Liquidating Fund.

PACIFIC SELECT FUND

On behalf of the Currency StrategiesInternational Equity Income Portfolio

| By: |  |  |

| Name: | Robin S. Yonis | |

| Title: | Vice President and General Counsel | |

| Date: |

A-4